Stamp Duty Changes: A homebuyer’s guide

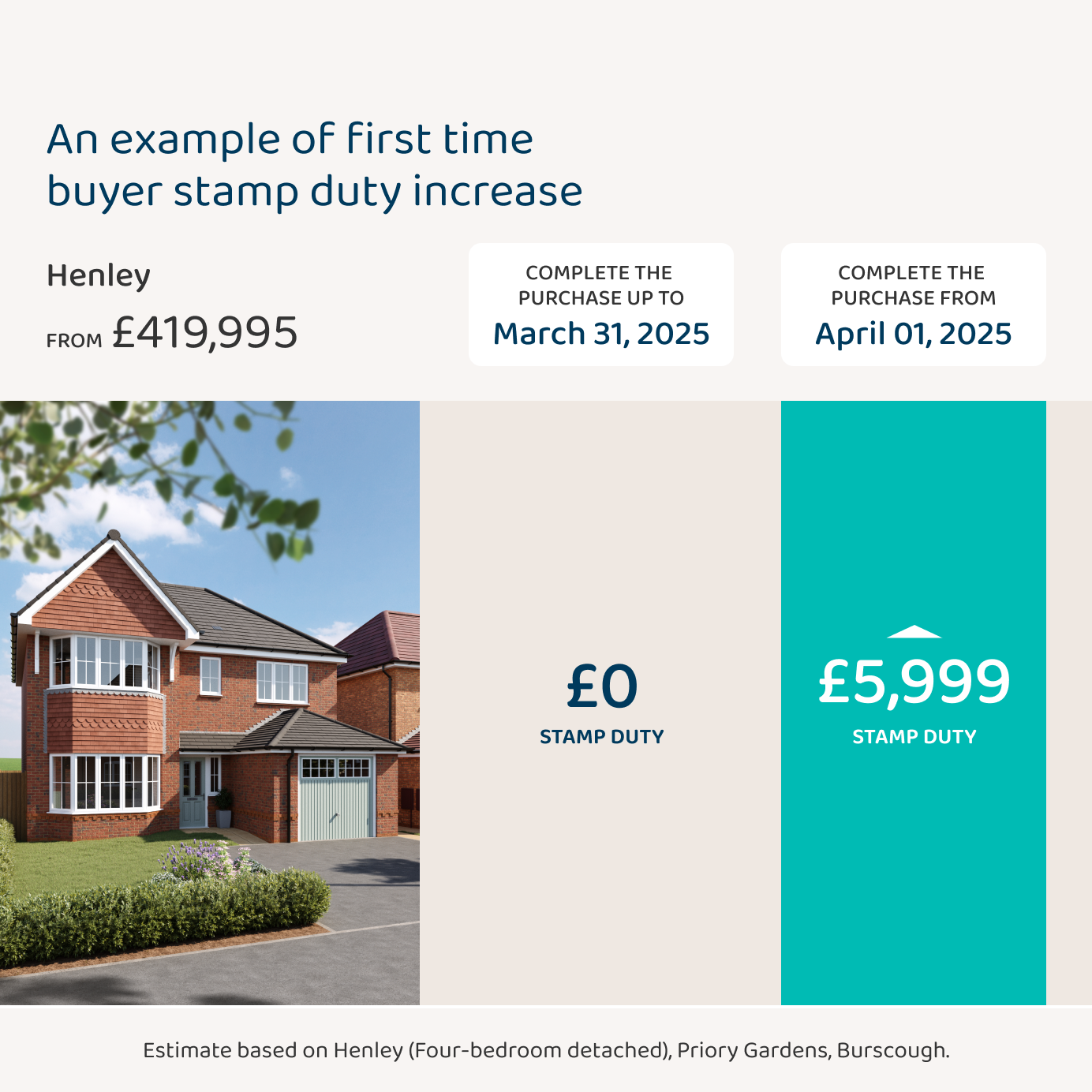

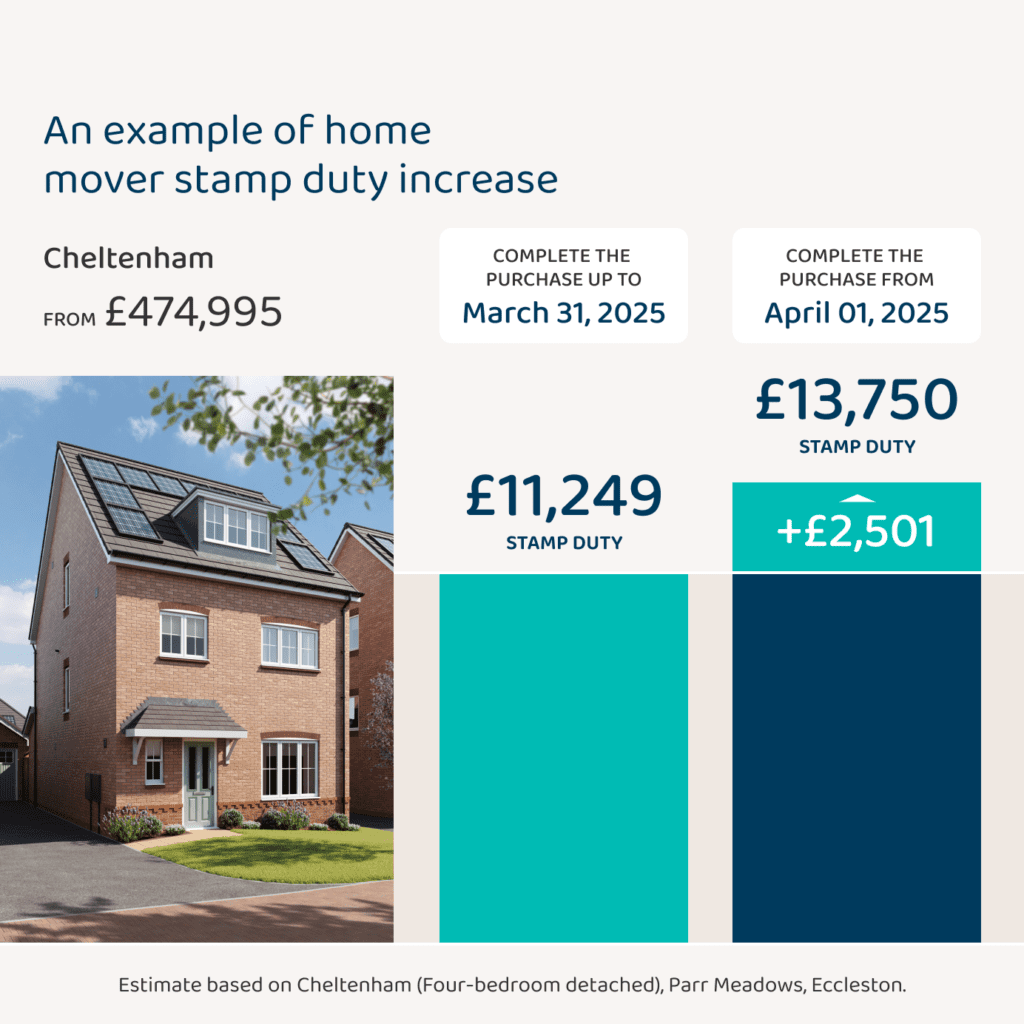

Stamp duty is changing and could add thousands of pounds to the cost of moving home if you complete after 1st April 2025.

What is stamp duty?

Stamp Duty Land Tax is a levy paid to the Government when buying a property in England. It’s more commonly known as stamp duty. This can vary depending on the price of the property, your buying status and the number of properties you own.

Why is stamp duty changing?

The previous Government had temporarily increased the thresholds for stamp duty, meaning no stamp duty was payable on a larger portion of a property price. This was to help boost the housing market by reducing some of the costs associated with moving home.

However, from 1st April 2025, stamp duty rates will change meaning lower thresholds and more stamp duty to pay. That’s where we come in! For a limited time, our Stamp Duty Contribution could help you save thousands on your move to your dream Anwyl home.

How will stamp duty change?

The current threshold above which stamp duty is paid on homes in England is £250,000 for movers replacing their main residence and £425,000 for first time buyers. Those thresholds are due to change from April 1 when they’ll reduce to £125,000 and £300,000 respectively.

How to work out how much stamp duty you’ll pay

You can use the stamp duty calculator on the government website to help work out how much stamp duty you’ll pay before March 31, 2025 or from April 1, 2025. You may want to add the cost of stamp duty onto your mortgage, but be aware that you’ll pay interest on this. It’s important you make an informed decision about how much you can afford to pay for a home. We can put you in touch with independent financial advisers with access to the entire mortgage market.

FAQs

-

Stamp duty needs to be paid within 14 days of the ‘effective date’ of the transaction, which is normally after the contracts have been exchanged and the sale has been completed.

Your solicitors or conveyancers may either ask for the amount in advance to pay it on your behalf during that 14-day window or pay it themselves and recover the monies as part of their fees.

-

Homebuyers are set to pay more stamp duty from 1 April 2025 onwards when two key thresholds will be reduced. This means the sale of a property before that date will fall under the current thresholds.

-

Until 31 March 2025, the stamp duty rates are:

- £0-£250,000 (£425,000 for first-time buyers on properties up to £625,000) = 0%

- £250,001-£925,000 = 5%

- £925,001-£1.5m = 10%

- £1.5m+ = 12%

However, from 1 April 2025, these will change to:

- £0-£125,000 (£300,000 for most first-time buyers on properties up to £500,000) = 0%

- £125,001-£250,000 = 2%

- £250,001-£925,000 = 5%

- £925,001-£1.5m = 10%

- £1.5m+ = 12%

-

This entirely depends on how much your house costs and whether you are a first-time buyer. Use the Government’s stamp duty calculator to work out how much land tax you will need to pay, if any.

-

It depends. This is because first-time buyers are given a relief on stamp duty, meaning they are exempt from paying land tax on properties up to £300,000 from 1 April 2025 (£425,000 if you complete before then).

However, this is only applicable on houses worth £500,000 or less (£625,000 if you complete before 1 April 2025). If you first home is worth more than £500,000, then standard stamp duty rates apply.

-

Yes, although it is slightly different, as it is called Land Transaction Tax (LTT).

For people who will be only owning one home, the rates stand as:

- Up to and including £225,000 – 0%

- Over £225,000 up to and including £400,000 – 6%

- Over £400,000 up to and including £750,000 – 7.5%

- Over £750,000 up to and including £1.5 million – 10%

- Over £1.5 million – 12%

For people buying a second home on top of their main residential property, the rates are:

- Up to £180,000: 5%

- £180,001 to £250,000: 8.5%

- £250,001 to £400,000: 10%

- £400,001 to £750,000: 12.5%

- £750,001 to £1.5 million: 15%

- Above £1.5 million: 17%

-

As a matter of fact, yes, we do! If you reserve your home with us by 30th April 2025 and complete by June, we will cover your stamp duty, saving you a potential £11,250. Find out more on our Stamp Duty contribution page.